A Distinct Capability Founded on a Rich History

With over 25 years of experience investing in high yield markets and private credit, Polen Capital extends its capabilities to Collateralized Loan Obligations (CLOs). With this capability, we seek to offer a specialized solution built on decades of expertise and a steadfast commitment to managing downside risk. Led by CLO-industry veterans with a distinguished track record, we craft income solutions designed to offer durable and compelling returns.

CLO Strategy

Consistent with Polen’s overarching investment philosophy, Polen's CLO strategy emphasizes mitigating risk, actively building par, and minimizing volatility to deliver value for investors.

What is a CLO?

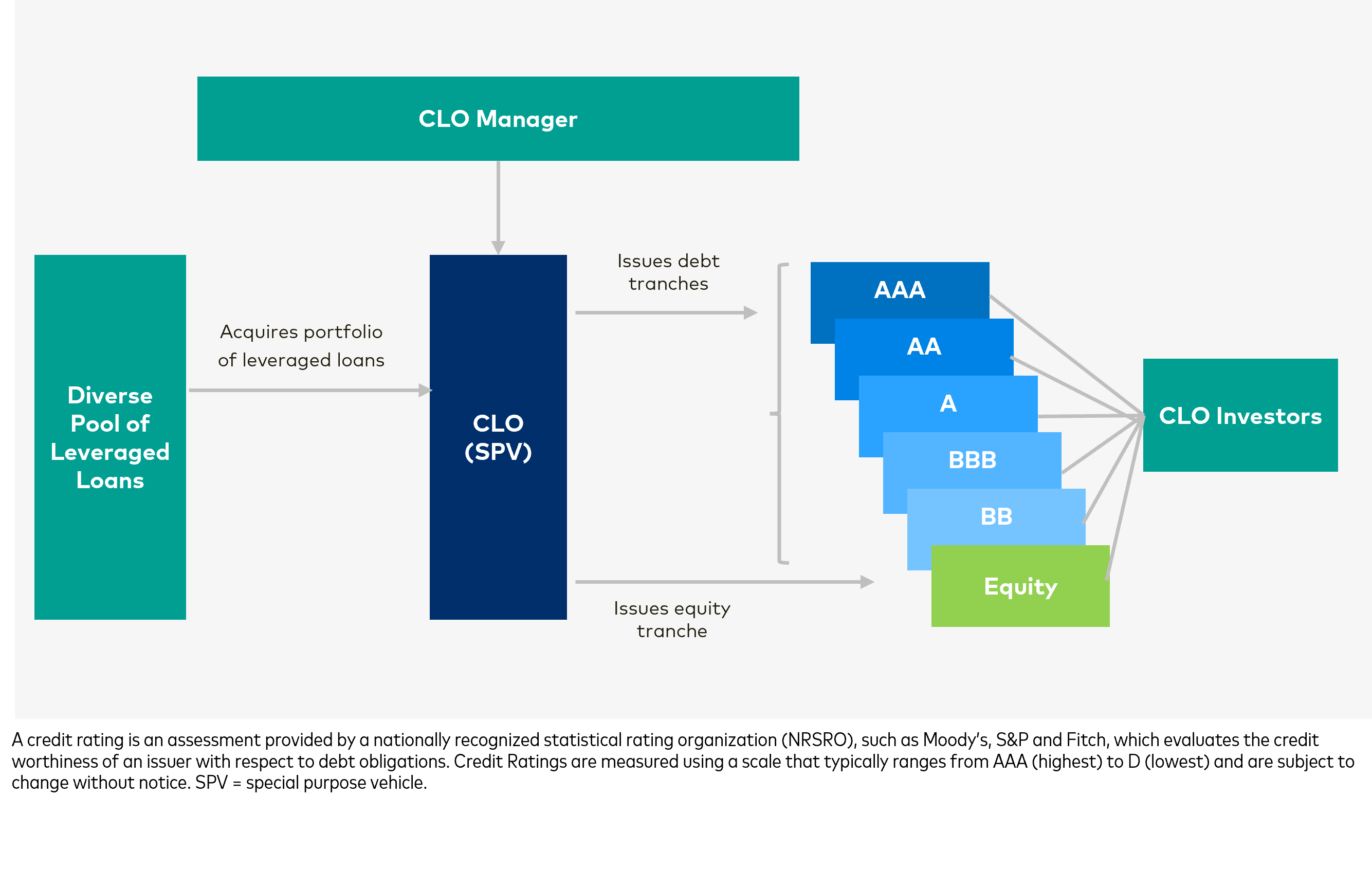

CLOs are structured finance vehicles that raise money from investors by issuing two types of tranches—debt and equity—to fund the purchase of a diverse pool of underlying corporate loans. The CLO manager actively manages these loans, as in an investment fund. Each tranche represents varying levels of risk and return to meet the needs of different investors.

CLO Securitization

Watch: More About Our CLO Strategy

Meet the Team

Polen Capital Credit, LLC, a wholly-owned subsidiary of Polen Capital Management, LLC, is an investment adviser registered with the SEC. Please find Polen Capital Credit, LLC ‘s Form ADV linked here and Polen Capital CLO Management's Form ADV linked here.

The information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of the period indicated, may involve a number of assumptions and estimates which are not guaranteed and are subject to change without update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness, or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without update, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. This information does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction.

Past performance does not guarantee future results and profitable results cannot be guaranteed.