Is AI a Threat to Software as a Service Companies?

Key Highlights

- While GenAI hardware providers have emerged as the early winners of the AI arms race, we believe that in the long term, most of the economic benefit of GenAI will accrue to services and software businesses.

- We believe investors should be cautious about extrapolating growth in semiconductors and hardware as much uncertainty clouds the long-term outlook.

- Though some software companies are experiencing modest slowdowns, we believe this dynamic has more to do with a softer macroeconomic backdrop and technology budget reprioritizations.

- We recommend a selective approach for investors seeking opportunities in the software space, favoring competitively advantaged businesses that provide mission-critical solutions.

The Artificial Intelligence Arms Race

Two years ago, the launch of ChatGPT provided one of the first glimpses of the possibilities of Generative Artificial Intelligence (GenAI) for consumer use, sparking a global spending boom as demand for foundational AI hardware surged. Like previous technological innovation cycles—most notably, the late 1990s internet boom—certain tech hardware and infrastructure companies have emerged as the early beneficiaries of the AI gold rush, with semiconductor manufacturers at the epicenter of AI-enablement among the biggest winners.

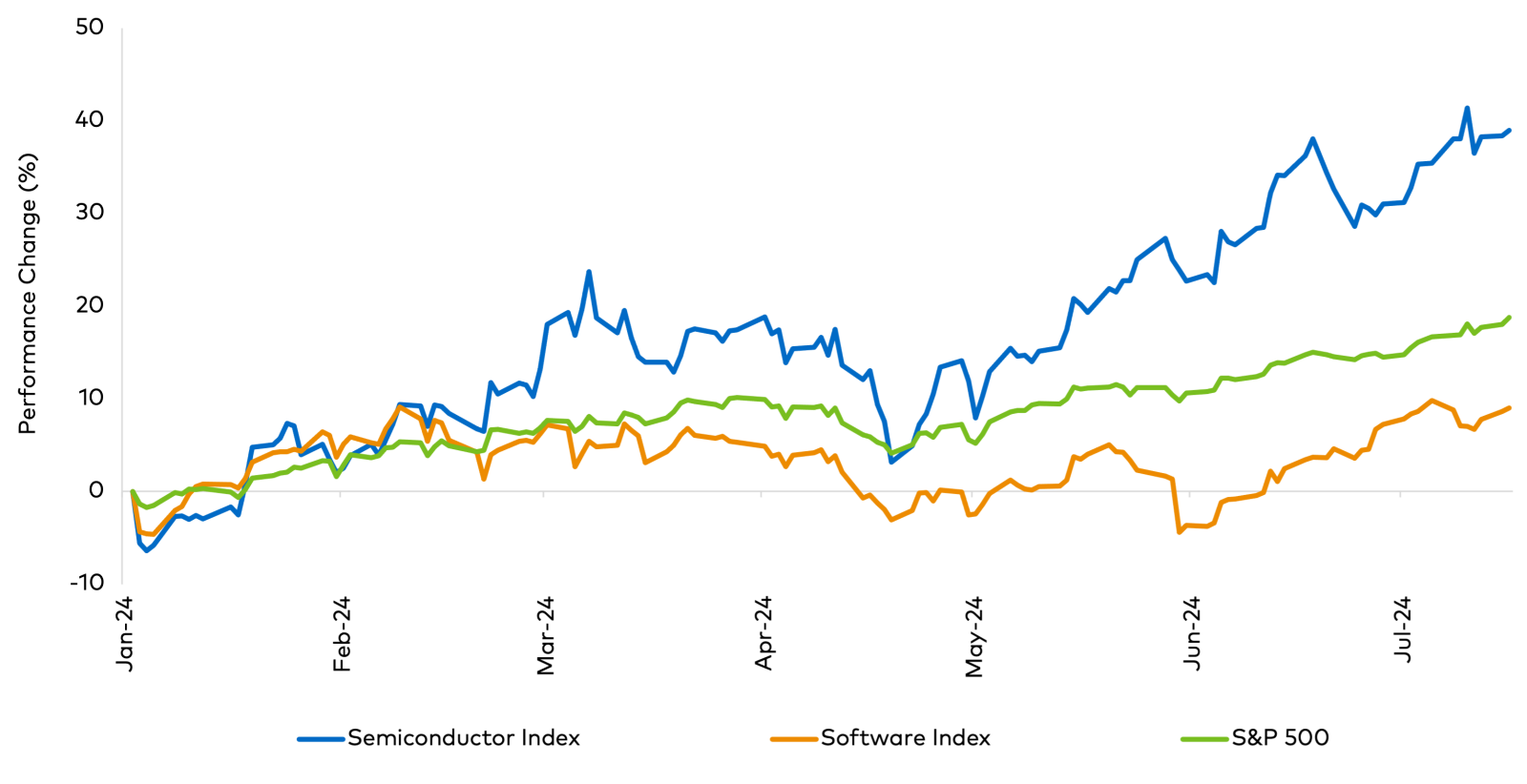

In our view, this trend was one of the main drivers of U.S. equity market performance during the first half of the year. Share prices of semiconductor stocks rallied significantly, particularly compared to those of software companies, many of which have recently reported slower-than-expected growth (see Figure 1).

Figure 1: Index Performance

Source: Bloomberg. As of July 17, 2024.

With spending on tech infrastructure being prioritized amid this AI arms race, software businesses have lagged even though nearly all of the large-cap software companies in our research coverage are integrating GenAI functionality into their solutions, which could ultimately be accretive to their revenue growth over the next several years.

This year, the divergence in performance between semiconductor stocks and software stocks has raised concerns that the software companies, far from being GenAI beneficiaries, could actually be GenAI victims. Our view is that the current malaise in software is likely more a result of macroeconomic weakness and not symptomatic of a deeper structural issue.

The Power of Software as a Service

Before GenAI emerged, Software as a Service (SaaS) was among the fastest-growing business models. SaaS businesses grew more than 300% during the 2010s, around five times faster than the revenues of the S&P 500 over the same period1. In our view, SaaS companies disrupted the legacy software model, which relied on floppy disks, CDs, and cumbersome on-the-ground installations with solutions that could be accessed via the cloud anytime and at often more reasonable prices.

As seen below in Figure 2, the proliferation of SaaS companies yielded several benefits for businesses seeking to digitize their operations. It also brought forward new pricing models such as Per-Seat-Pricing to the forefront, which enabled companies to pay a subscription price for each user. This model made it easier for customers to manage their subscription expenses and granted SaaS providers the ability to generate predictable revenues.

Figure 2: The Benefits of Software as a Service

Source: Polen Capital.

Yet, the rapid evolution of GenAI tools has led some market participants to believe that GenAI will help companies automate many jobs, reducing the number of workers needed. According to this narrative, a reduction in employee headcount could translate into fewer software subscriptions, resulting in lower revenues for SaaS companies over the following years. Within this narrative, we believe there are some elements of truth.

Based on the research of some of our software holdings, there appears to be an increased recognition that the current software pricing models may need to be reconfigured. Still, even in this scenario, mission-critical software solutions should effectively be able to price for the value they provide to their customers.

Beyond this, what is evident from our research is that large enterprises are currently scrutinizing their IT spending due to macro pressures, and this has prompted many of them to be more cautious about their software dollars. In our opinion, a good example is human capital management (HCM) software provider Workday's most recent earnings commentary2.

Staying Grounded: Drawing Parallels

In many ways, we see parallels between the emergence of GenAI and its effect on software companies and the breakthrough of glucagon-like peptide-1 medications (commonly known as GLP-1s), which treat diabetes but have been found in medical trials to suppress appetite and induce weight loss, in addition to appearing effective in combating heart disease3.

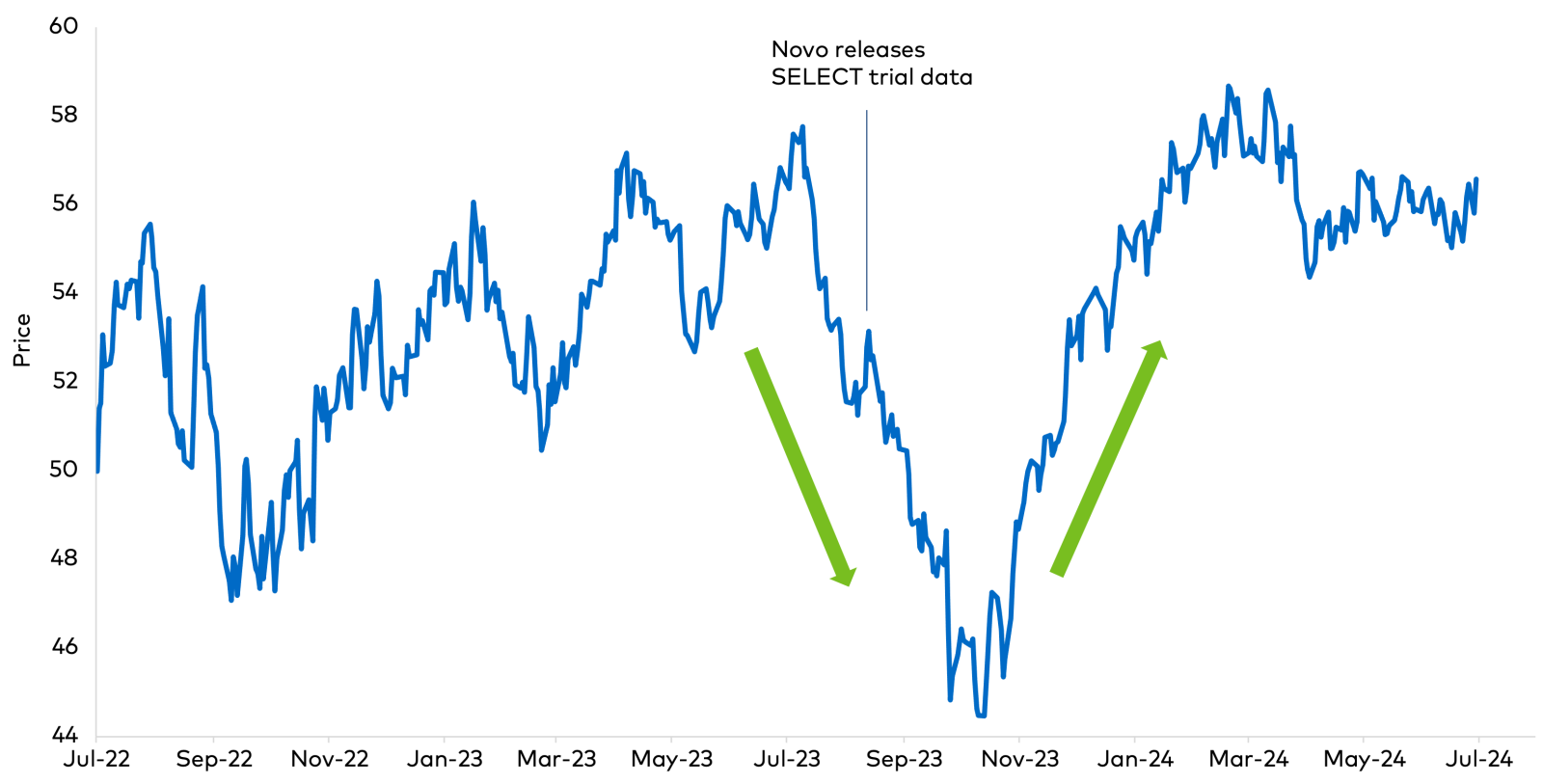

Last year, shares of medical device manufacturers sold off after clinical trial data showed that GLP-1s could have beneficial effects not just on obesity but on other related diseases such as cardiovascular and chronic kidney disorders. Investors speculated that the potential benefits of GLP-1s could reduce the need for various medical devices, ranging from glucose monitors to kidney dialysis treatments4.

The resulting "GLP-1 effect" cast a pall over medical stocks last year, and the industry saw a rapid drawdown between July and October, as seen in Figure 3. Nevertheless, a report by Reuters noted that the high prices of weight-loss drugs, uncertainty about the long-term benefits, possible side effects, and the potential lack of insurance coverage for the costs could lessen the impact on medical device manufacturers' revenue5.

Figure 3: iShares U.S. Medical Devices ETF Performance

Source: Bloomberg. As of July 17, 2024. August 8, 2023: Novo Nordisk announced the results from the SELECT cardiovascular outcomes.

After the initial selloff of healthcare stocks, the group has staged a comeback, signaling that the initial wave of fear may have been an overreaction. Since then, a new narrative has emerged, stating that a healthier customer base may be a boon for medical device manufacturers since healthier patients may be more active in tracking their well-being and continue buying medical products to monitor their progress.

Evolution, not Extinction

At Polen Capital, we do not believe that the arrival of GenAI will spell the end for SaaS companies. And, even if GenAI leads to fewer "seats," software companies that provide mission-critical solutions should remain in high demand. Throughout the more than three decades since our inception, we have seen similar dynamics in other subscription businesses when there was customer captivity for essential products and services.

Furthermore, innovative software companies are already exploring new revenue models to combat the risk of declining user numbers and better monetize AI-driven productivity gains. Salesforce6, for example, has introduced three tier-based subscriptions offering GenAI features. The company is also currently testing a usage-based model, where customers are charged based on use volume. Since GenAI relies heavily on computer power, this new model would enable them to profit from their customers' use of AI rather than suffer from it.

Meanwhile, other software companies like Adobe7 are leading the development of novel GenAI solutions, which we believe will add to their revenue growth. Adobe's Firefly tool uses GenAI to streamline the content creation process, eliminating manual and repetitive tasks and creating value for customers by boosting productivity8. Though some software companies are experiencing modest slowdowns in their businesses, as noted previously, we believe this dynamic has more to do with a softer macroeconomic backdrop and technology budget reprioritizations than a structural downturn across the industry.

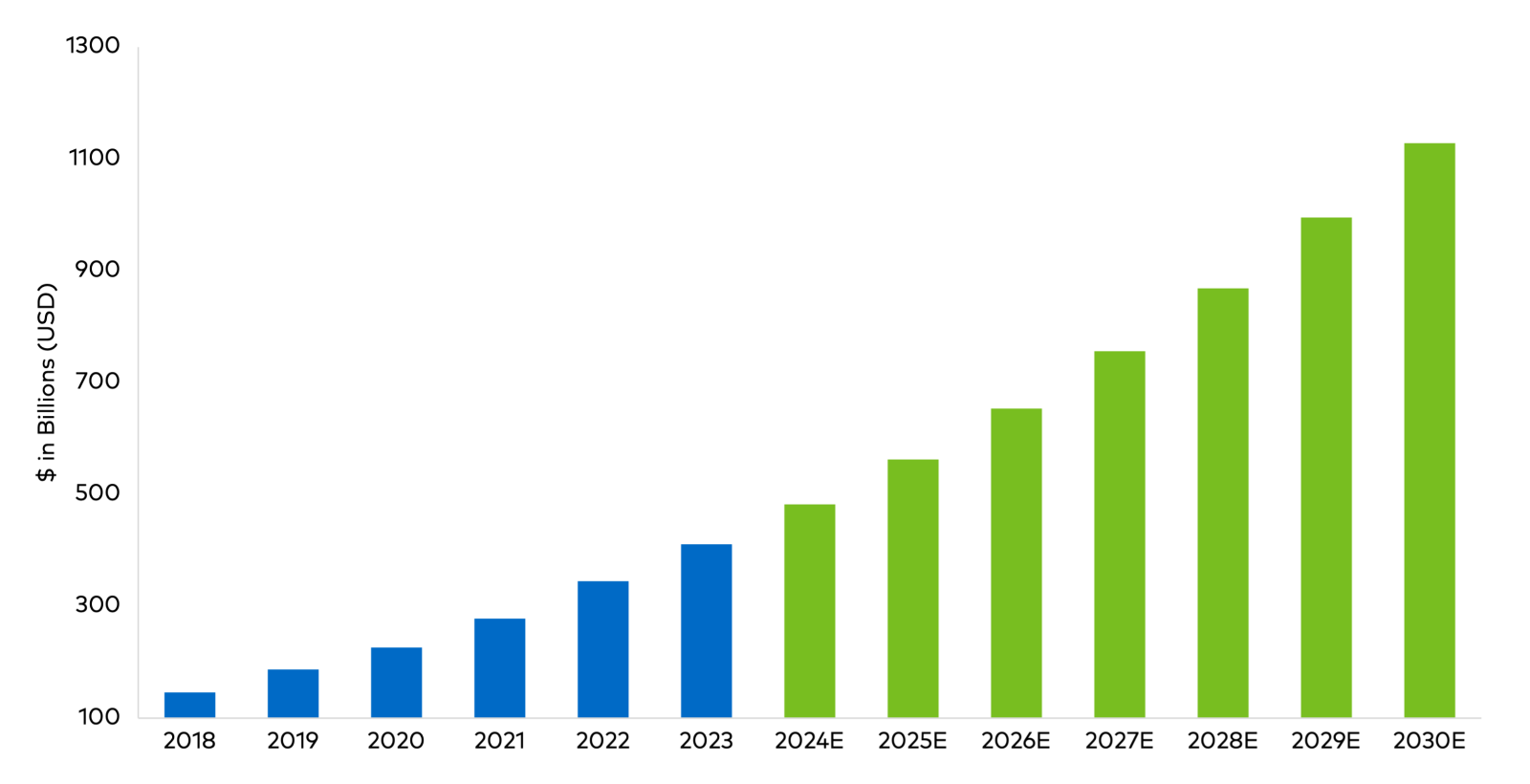

In fact, Bloomberg forecasts total SaaS spending to grow 15-16% annually to over $1.1 trillion by the end of the decade, as shown below in Figure 49. Moreover, Bloomberg estimates that the development of GenAI solutions could add about $280 billion to new software revenue, representing a significant opportunity for those companies able to gain market share10.

Figure 4: SaaS Market Spending Forecast

Source: Bloomberg. IDC. As of July 16, 2024. E= Bloomberg Estimates.

Investor Takeaways: A Symbiotic Relationship

In the early innings of technologically driven landscape shifts, we believe it is logical that hardware and semiconductor companies lead the charge. We saw this dynamic play out in the lead-up to the dot-com boom11 with companies like Corning—then with a monopoly on the production of fiber optic cable—Cisco Systems—at the time the dominant supplier of routers and switches to move data across the internet—and Sun Microsystems—a former maker of servers and workstations—experiencing sharp price gains12.

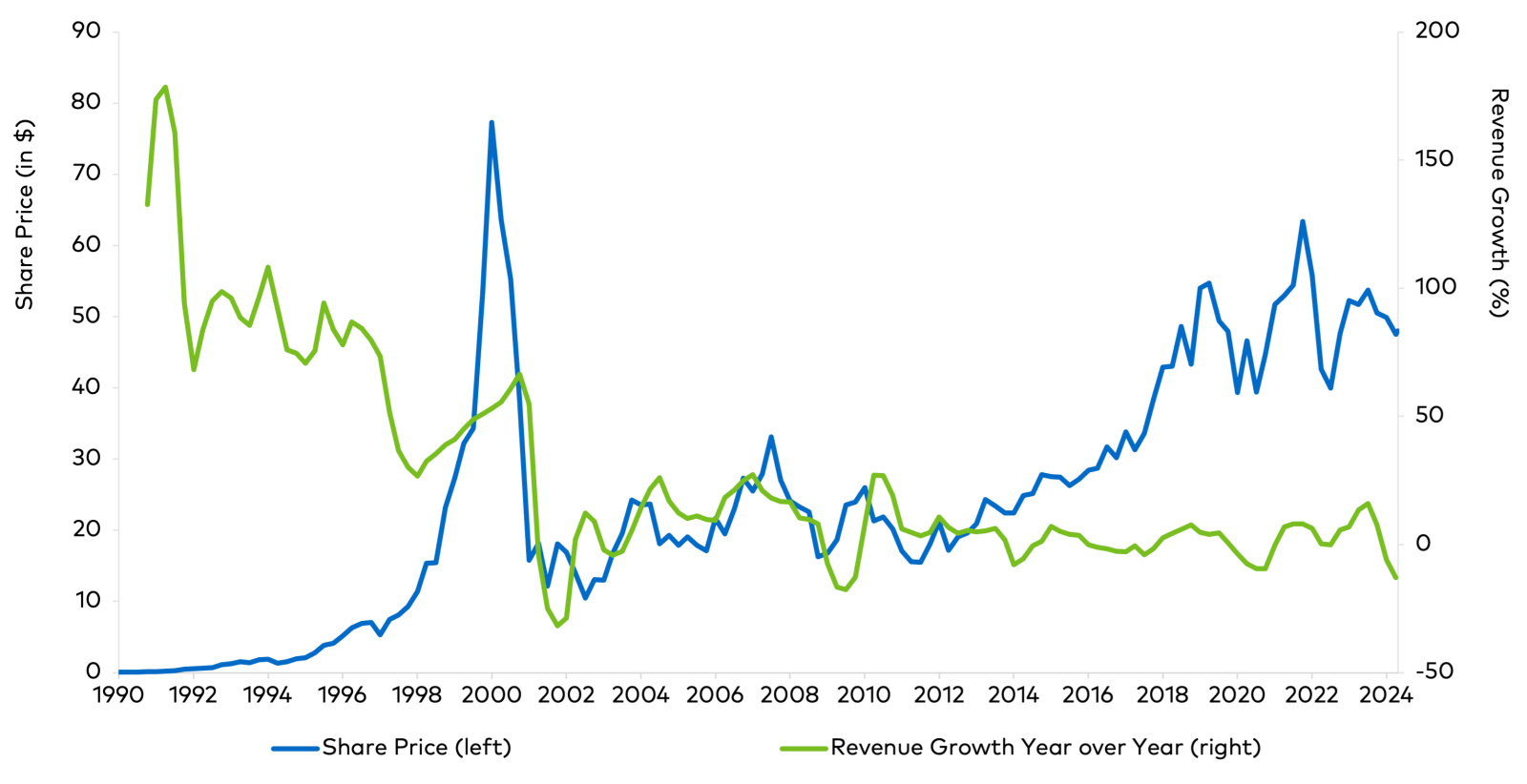

With time, though, we saw that the massive tech infrastructure buildout turned out to be overdone, and some of the early winners ended up experiencing sharp declines and material revenue deceleration, as illustrated by Cisco's performance below in Figure 5.

Figure 5: Cisco Historical Performance

Source: Bloomberg. IDC. As of July 9, 2024.

Therefore, we believe investors should exercise caution amid the rally in hardware companies, given that, as we have seen previously, market participants tend to extrapolate this kind of hypergrowth into the future. In our view, the nature of hardware is that customers order a lot to build upfront capacity but then pause to evaluate the need for more and then add incrementally, but typically not in the same magnitude as during the initial arms race. In our experience, this causes the boom-and-bust cycles we have seen in cyclical industries in previous years.

Despite our constructive outlook on the software sector, we believe that not all software companies are created equal. While we believe that in the long-term, most of the economic benefit of GenAI—which remains largely untapped—will accrue to services and software businesses, our view is that the divergence of winners and losers across these industries will widen as some become AI champions and others may be displaced by competitors.

Therefore, we recommend a selective approach for investors seeking opportunities in the SaaS space, targeting competitively advantaged companies with high customer retention rates and mission-critical enterprise software products. From our perspective, these companies will be able to weather future headwinds by leaning on pricing power and effectively monetizing GenAI in their product suite, supporting our view that GenAI will spark an evolution in software, not extinction.

Important Disclosures

1 Source: Harvard Business Review. As of April 18, 2023. The Rebirth of Software as a Service (hbr.org).

2 Source: Bloomberg. As of May 23, 2024. Workday Warns of ‘Elevated Sales Scrutiny’ in Warning for Software. Workday is a holding in Polen's Global Growth portfolio as of June 30, 2024.

3 Source: Bloomberg. As of August 18, 2023. GLP-1 Drugs Are Coming, and They Could Change Everything. Ozempic May Lower Risk of Obesity-Related Cancers, Study Finds.

4 Source: Bloomberg. September 29, 2023. Weight-Loss Drugs Like Ozempic, Wegovy Divide Investors on Medical Device Stocks.

5 Source: Reuters. As of October 27, 2023. Healthcare companies counter investor worries over Wegovy effect.

6 Salesforce is a holding in Polen's Focus Growth portfolio as of June 30, 2024.

7 Source: Adobe is a holding in Polen's Focus Growth portfolio as of June 30, 2024.

8 Source: Adobe Firefly Product Guide. As of 2024.

9 Source: Bloomberg Intelligence. As of June 27, 2024. SaaS Market Spending Set to Hit $1.1 Trillion in 2030.

10 Source: Bloomberg. As of June 1, 2023. Generative AI to Become a $1.3 Trillion Market by 2032, Research Finds.

11 The dotcom bubble was a rapid rise in U.S. technology stock equity valuations fueled by investments in Internet-based companies during the late 1990s (1995–2000).

12 Corning and Cisco are not part of any Polen Capital strategies as of June 30, 2024.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of July 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements that are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

The Philadelphia Semiconductor Index is a modified capitalization-weighted index comprised of companies that are involved in the design, distribution, manufacturing, and sale of semiconductors.

S&P North American Expanded Technology Software Index provides investors with a benchmark that represents U.S. traded securities that are classified as application software, systems software, home entertainment software, sub-industries, and applicable supplementary stocks.

The S&P 500® Index is a market capitalization weighted index that measures 500 common equities that are generally representative of the U.S. stock market. The index is maintained by S&P Dow Jones Indices.

iShares U.S. Medican Devices ETF is an exchange-traded fund incorporated in the United States. The ETF tracks the performance of the Dow Jones U.S. Select Medical Equipment Index. The ETF holds health care stocks of varying cap sizes. Its investments are focused in health care equipment and supplies. The ETF weights the holdings by market capitalization.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided on a confidential basis for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital.

The information provided in this content should not be construed as a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will be in the composite at the time you receive this document or that any securities sold have not been repurchased.

The securities discussed do not necessarily represent the composite’s entire portfolio. Actual holdings will vary depending on the size of the account, cash flows, restrictions, and any trade orders in progress on the date as of when holdings are shown. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable or that any investment recommendations we make in the future will equal the investment performance of the securities discussed herein. For a complete list of Polen’s past specific recommendations holdings and current holdings as of the current quarter end, please contact [email protected].