Castle on a Cloud

At a time when companies such as Nvidia and Open AI garner much of the attention regarding generative AI (GenAI), quotes like this from Matt Garman, CEO of Amazon Web Services, underscore why we continue to be optimistic about the long-term opportunities in cloud infrastructure.

“We’re about 18 years into the cloud now, so it’s a pretty well-established technology. And yet, there’s still the…vast majority of workloads that have yet to move to the cloud. [There are] lots of estimates…[but] I think you’re hard-pressed to find somebody who thinks it’s more than 10% to 20% of the workloads out there.”

- Matt Garman, CEO of Amazon Web Services1

Simply put, we view the “Big Four” hyperscale cloud companies as building the backbone on which all significant workloads, AI or otherwise, will likely run.2 Here’s why we think these businesses should be well-positioned over the next decade.

Hyperscale Cloud Businesses: Fortresses of Capabilities

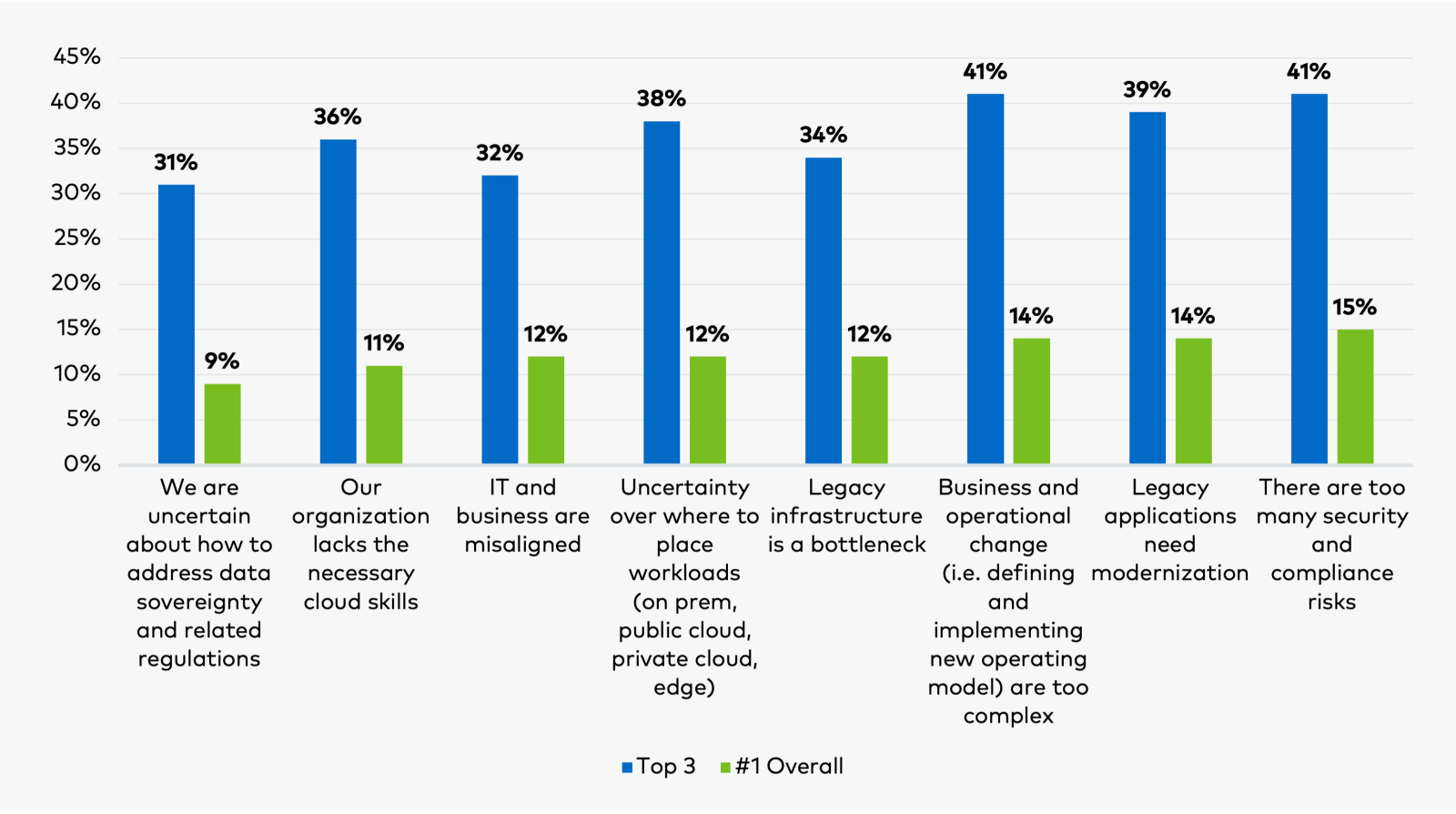

Our research indicates that the number of workloads that have shifted to the cloud is still in the relatively early stages. Why is this the case? There are several factors that have impeded migration thus far, some of which include security and compliance risks, the need to modernize legacy applications before shifting them to the cloud, as well as the operational and implementation complexity for some enterprises to shift from on-premise infrastructure to cloud data centers (Figure 1).

Figure 1: Barriers Preventing Companies from Fully Achieving Their Cloud Outcomes (percent citing as a top concern)

Source: Accenture, “The Race to the Cloud,” January 2023. Results are based on Accenture’s proprietary research as well as a global survey of 800 business and IT leaders.3

However, the advantages of shifting to the cloud are significant enough that we expect that even the organizations that have had more challenges in their cloud transition thus far will continue making real progress on their technology journeys, causing the cloud penetration rate to move substantially higher over the next decade. Research from Gartner, the IT research firm, supports this view, predicting that 70% of workloads will run in a cloud environment by 2028, up from only 25% in 2023.4

Gartner’s estimate of current adoption is only slightly higher than Garman’s, who further remarked, “We're spending a lot of time helping customers because…if you could really give them an “easy button” [they could] just push…most people would move those workloads [to the cloud] in a heartbeat.” At Polen, we agree and believe that adoption could be further augmented if we continue to see an increased number of AI-related workloads, either generative or traditional, as they are often significantly more compute-intensive than non-AI workloads.

AI-related workloads generally require higher-end servers with faster processing power, something that hyperscale cloud companies can provide efficiently and on demand for customers. Additionally, cloud companies offer many of the tools and training models that can make it easier for developers to create new AI applications. When you combine these advantages with the other benefits of shifting to the cloud—including increased flexibility, agility to adopt new services, and improved security—we believe it’s likely that more enterprise workloads will be moving to the cloud for many years into the future.

Increasing Competitive Moats

We believe that the barriers to entry for cloud infrastructure have become quite high, though there are pros and cons to this development. On the negative side, these businesses have rapidly become more capital-intensive than they used to be. We estimate the combined capital expenditures (CapEx) in 2024 of the Big Four cloud companies will be between $150-$200 billion, with the majority of this spend likely going to their cloud segments to construct more data centers and purchase more chips, servers, and networking equipment.

On the positive side, however, the significant CapEx requirements likely make it difficult for any would-be competitors to achieve meaningful market share. We currently estimate that the market share of the Big Four in public cloud infrastructure and services is at least 80% (ex-China). Additionally, while the heavy CapEx spend is not ideal from a shareholder perspective because it reduces free cash flow and increases depreciation expenses, we would note that this spend is reflective, at least in some part, of demand for cloud infrastructure services on the part of enterprises, particular AI-related services.

Microsoft, for example, has noted that demand for its AI services within the company’s Azure cloud segment has “remained higher than our available capacity” and that future capital expenditures for their cloud business are “dependent on demand signals and adoption of our services.”5 We’ve heard similar refrains from the other hyperscale cloud companies and thus take comfort that if demand for their cloud services were to wane these companies would likely reduce capital spending as necessary.

An Alluring Opportunity

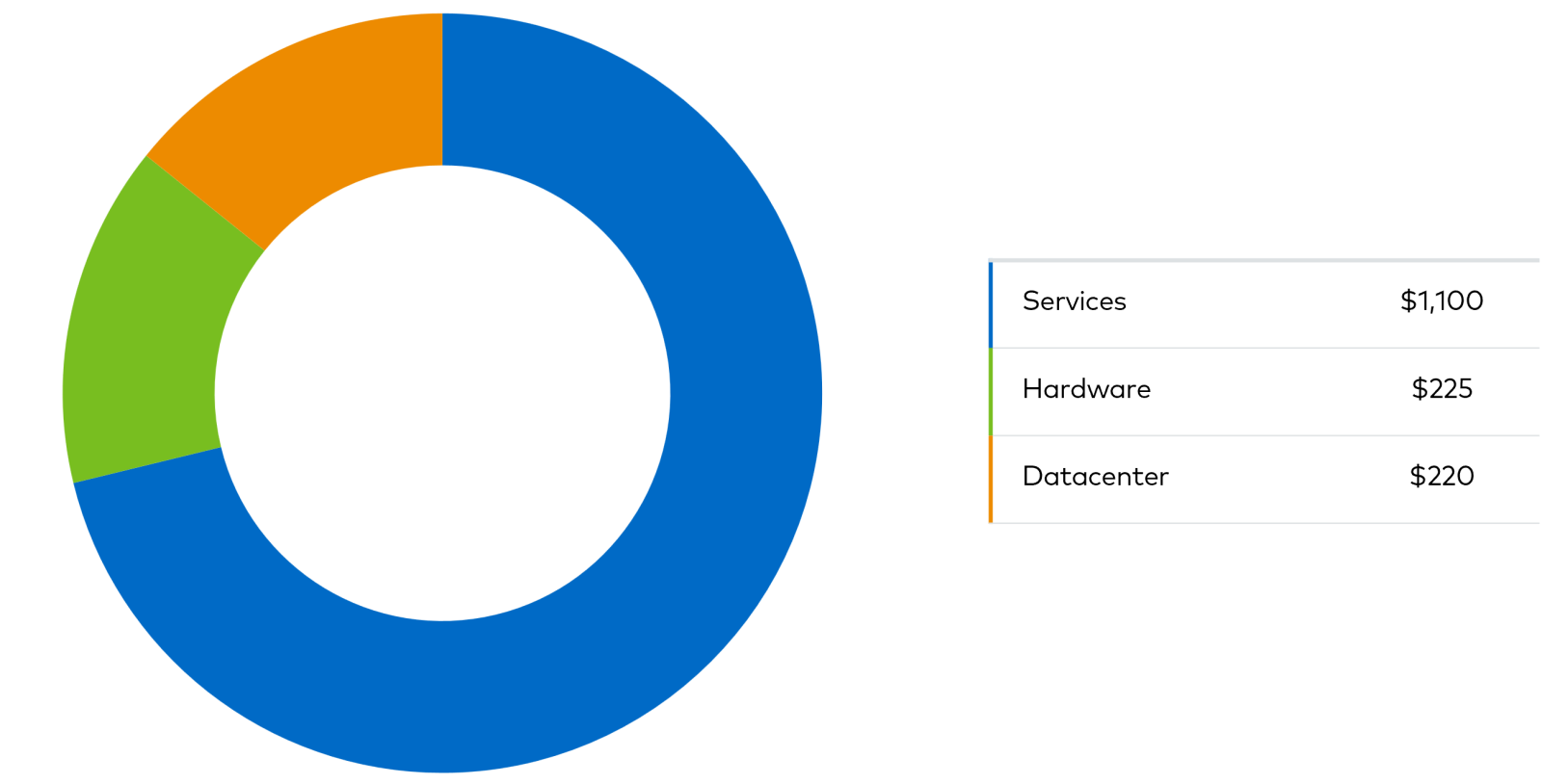

As of 2022, the estimated market opportunity for hyperscale cloud companies was approximately $1.5 trillion (Figure 2). We believe it is likely even larger now, due in part to the significant ramp-up in GenAI investments over the past couple of years. This substantial market value represents, in our estimation, about half of global enterprise IT spend, as we conservatively account for the fact that some portion will likely not be directly addressable by hyperscale cloud companies. Examples include software as a service (SaaS), telecom services, and certain on-premise workloads that are not likely candidates for migration.

Figure 2: Addressable Market for Hyperscale Cloud Companies ($ Billions)

Source: Bernstein, data as of year-end 2022.

Still, even with what we believe to be a conservative estimate for the potential addressable market for the hyperscale cloud companies, the current cloud infrastructure revenue base of the Big Four market leaders indicates there is still ample room for growth, according to our research. It’s a compelling opportunity we encourage investors not to overlook, amid the other popular technology market narratives that abound.

Important Disclosures

1 Comments made at the Goldman Sachs Communacopia Technology Conference, September 9, 2024.

2 The “Big Four” companies are Amazon, Microsoft, Alphabet, and Oracle, all of which were holdings in Polen’s Focus Growth and Global Growth strategies as of September 30, 2024. We exclude China’s Alibaba from the “Big Four,” as it primarily caters to China-based enterprises.

3 Accenture is a holding in Polen Capital’s Focus Growth and Global Growth strategies as of September 30, 2024.

4 Gartner, Cloud Computing in 2028: From Technology to Business Necessity, November 2023. Gartner is a holding in Polen Capital’s Focus Growth strategy as of September 30, 2024.

5 Microsoft Q4 2024 earnings call.

This information has been prepared by Polen Capital without taking into account individual objectives, financial situations or needs. As such, it is for informational purposes only and is not to be relied on as, legal, tax, business, investment, accounting, or any other advice. Recipients should seek their own independent financial advice. Investing involves inherent risks, and any particular investment is not suitable for all investors; there is always a risk of losing part or all of your invested capital.

No statement herein should be interpreted as an offer to sell or the solicitation of an offer to buy any security (including, but not limited to, any investment vehicle or separate account managed by Polen Capital). Recipients acknowledge and agree that the information contained herein is not a recommendation to invest in any particular investment, and Polen Capital is not hereby undertaking to provide any investment advice to any person. This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Unless otherwise stated, any statements and/or information contained herein is as of the date represented above, and the receipt of this information at any time thereafter will not create any implication that the information and/or statements are made as of any subsequent date. Certain information contained herein is derived from third parties beyond Polen Capital's control or verification and involves significant elements of subjective judgment and analysis. While efforts have been made to ensure the quality and reliability of the information herein, there may be limitations, inaccuracies, or new developments that could impact the accuracy of such information. Therefore, the information contained herein is not guaranteed to be accurate or timely and does not claim to be complete. Polen Capital reserves the right to supplement or amend this content at any time but has no obligation to provide the recipient with any supplemental, amended, replacement or additional information.

Any statements made by Polen Capital regarding future events or expectations are forward-looking statements and are based on current assumptions and expectations. Such statements involve inherent risks and uncertainties and are not a reliable indicator of future performance. Actual results may differ materially from those expressed or implied.

There is no assurance that any securities discussed herein are currently held in a Polen Capital portfolio nor that they are representative of the entire portfolio in which they are or were held. It should not be assumed that any transactions related to the securities discussed herein were (or will prove to be) profitable or that any future transactions will equal the investment performance of the securities discussed herein.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Past performance is not indicative of future results.

This information may not be redistributed and/or reproduced without the prior written permission of Polen Capital.

20241010-3916207