Leveraged Credit 2024 Midyear Review & Outlook

Our credit team analyzes the factors shaping leveraged credit markets and considers the possible implications of a "higher-for-longer" rate environment through the second half of the year and beyond.

Highlights & Key Takeaways

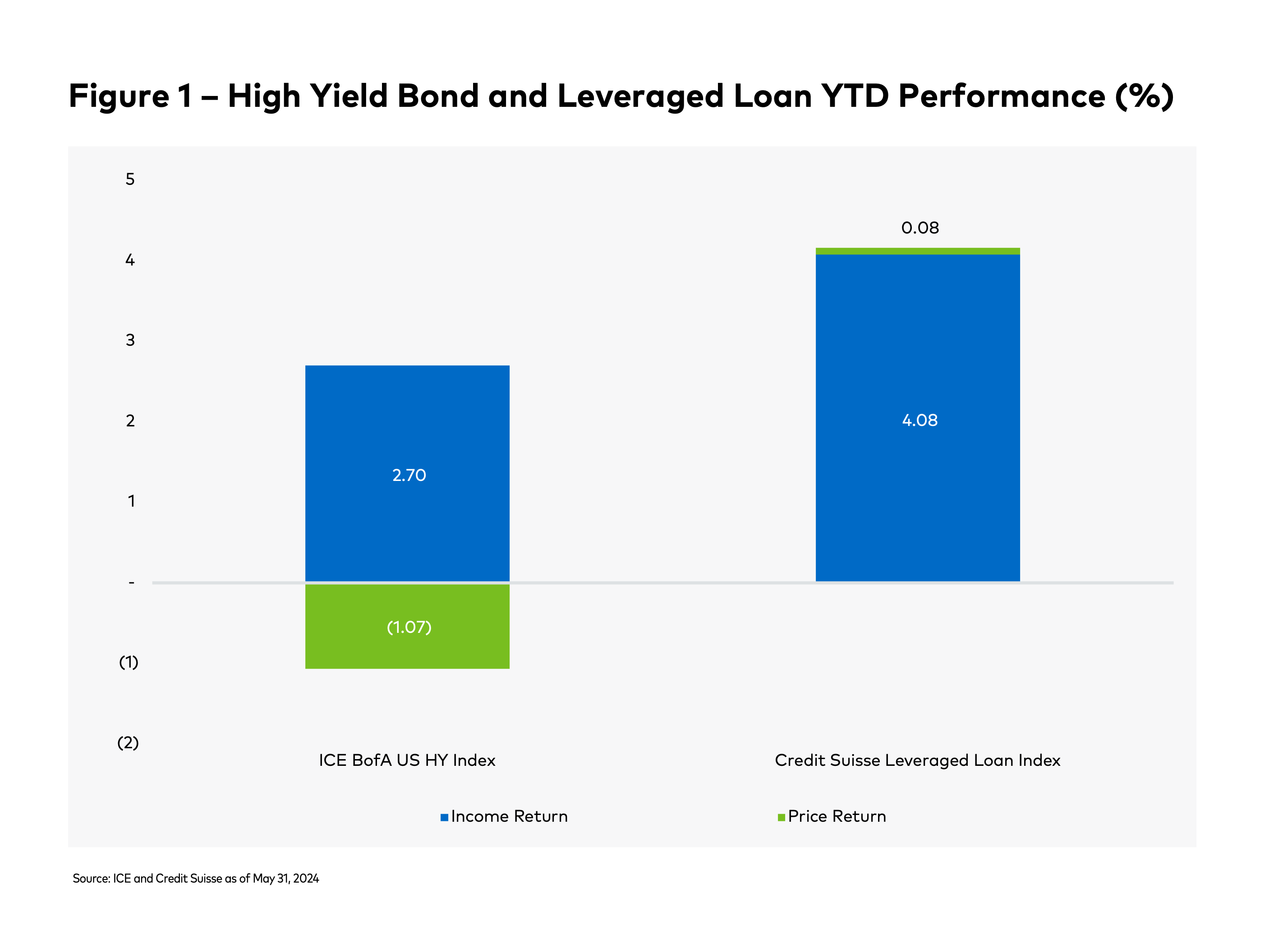

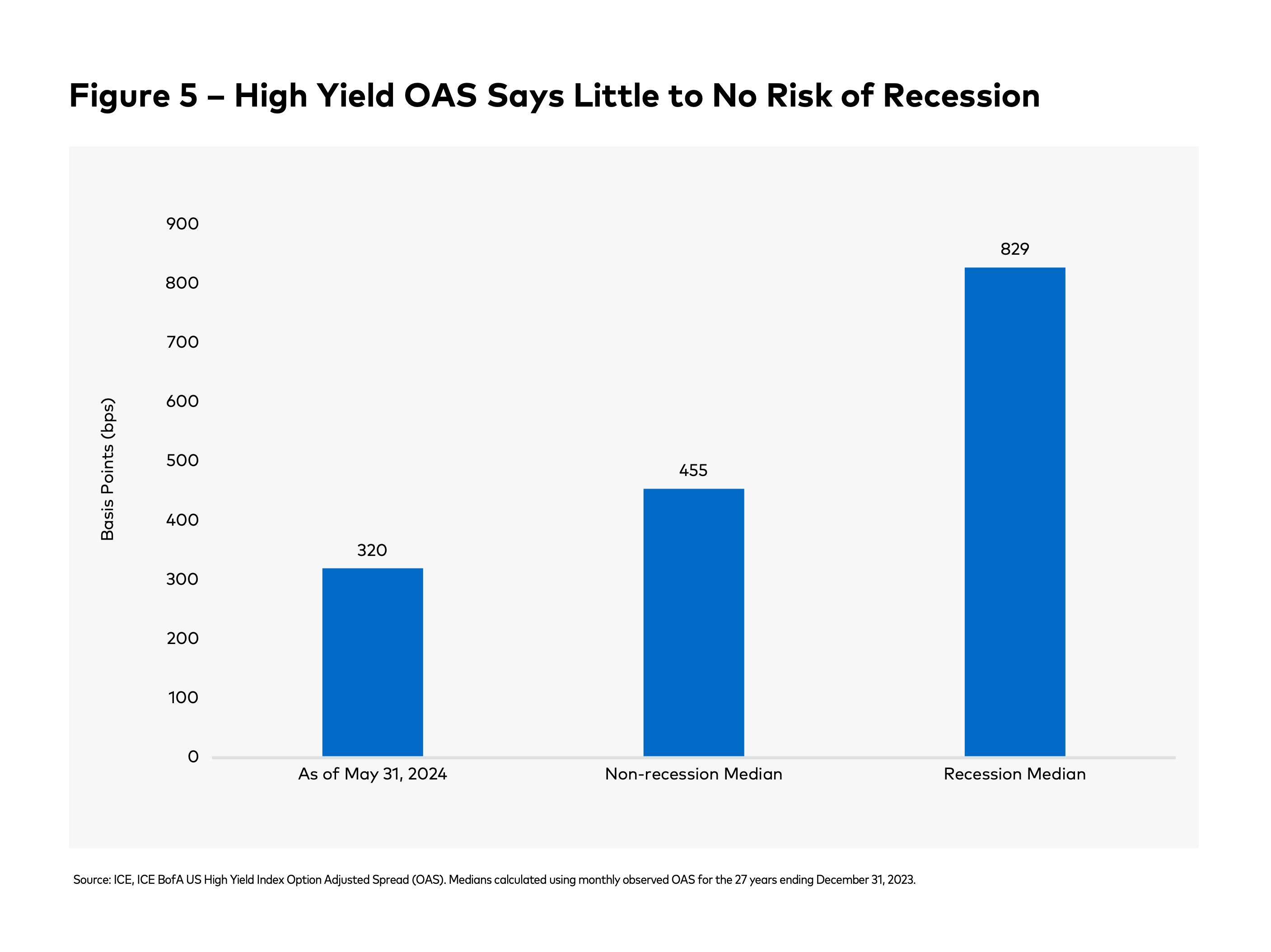

- In 2024, both high yield bond and leveraged loan markets continue to grind tighter in the face of increasing U.S. Treasury yields, as well as continued domestic and geopolitical angst.

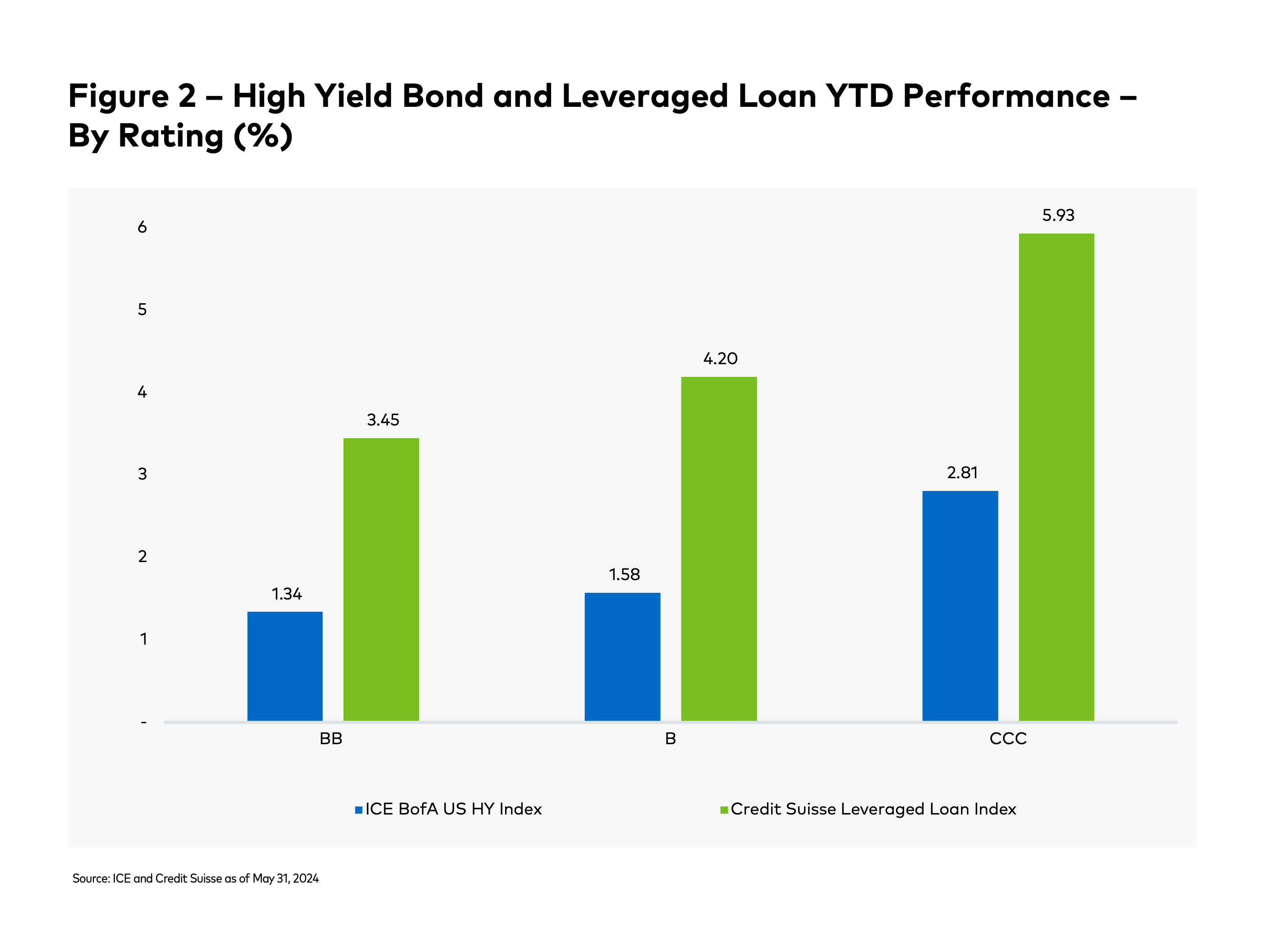

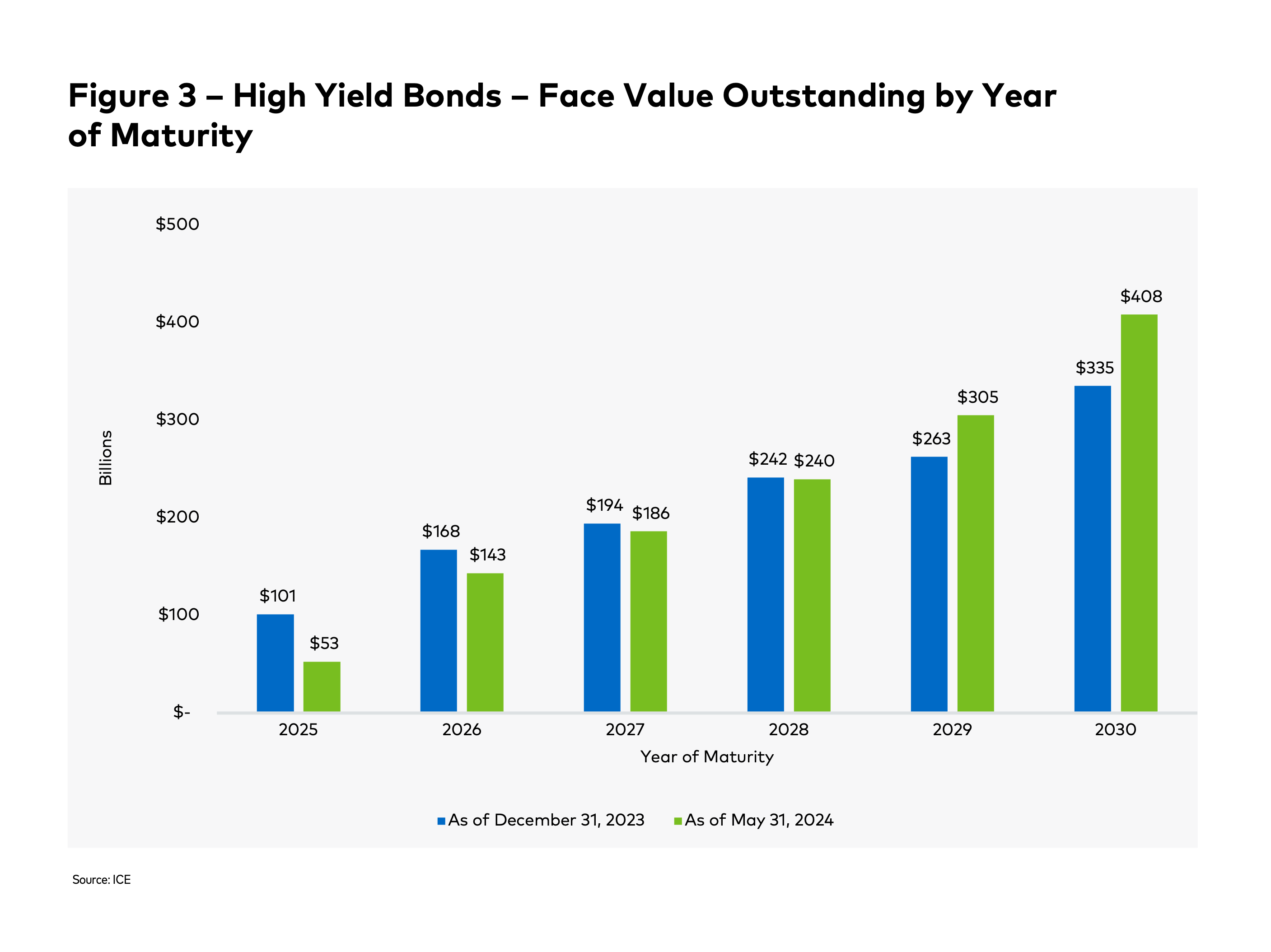

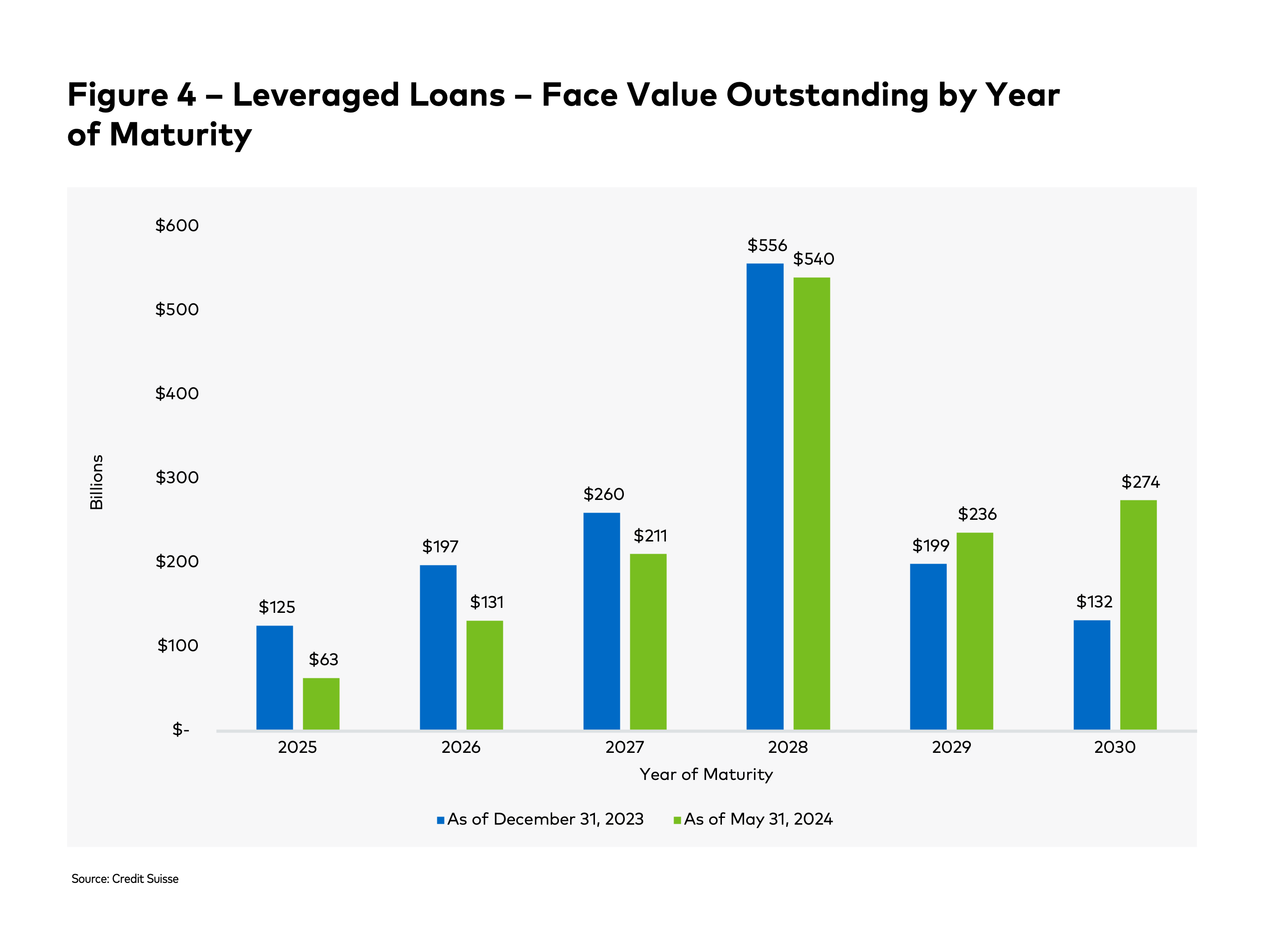

- Leveraged credit issuers have exploited wide-open capital markets to refinance existing debt. Issuers of lower-rated credits, many of whom had been on the sideline for most of 2022 and 2023, returned to the primary market.

- Given that financial conditions remain relatively accommodative, default rates, although elevated from the historical lows of 2021-2022, remain around the long-term average of 3%.

- Our team maintains a constructive view of the high yield bond and leveraged loan markets, though we anticipate volatility in the coming quarters. The current environment demands a higher degree of caution, and therefore, careful credit selection within the high yield and leveraged loan markets remains paramount.

- We believe current yield levels in high yield bond and leveraged loan markets are compelling and more than compensate investors for the increased risk associated with tighter spreads.

Explore All Charts

Leveraged credit markets continue to benefit from the belief that the U.S. Federal Reserve can orchestrate a soft landing. Inflation has fallen, resulting in a pause in rate activity. Although economic activity has slowed, it nonetheless continues to expand. However, an unexpected turn in inflation could lead to higher rates and less accommodative capital market conditions.

Important Disclosures

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of June 2024 and may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness, or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Please note that one cannot invest in the index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of USD institutional leveraged loans, including U.S. and international borrowers. Please note that one cannot invest in the index.