The Future of Aging: Medtech Solutions for a Healthier Tomorrow

Polen Capital’s International Growth team considers medtech opportunities arising from a rapidly aging global population.

Key Highlights

- The global population is aging rapidly, leading to extended lives, increased prevalence of chronic conditions requiring monitoring and treatment, and greater attention to health care generally.

- Due to this aging dynamic, we see expanding needs for medtech (a combination of the medical and technology fields).

- Medtech applies organized technological knowledge to improve health care services' quality, safety, effectiveness, and efficiency, impacting individuals from prevention to diagnosis to cure.

- We view this innovative merging of medicine and technology as a compelling long-term investment opportunity.

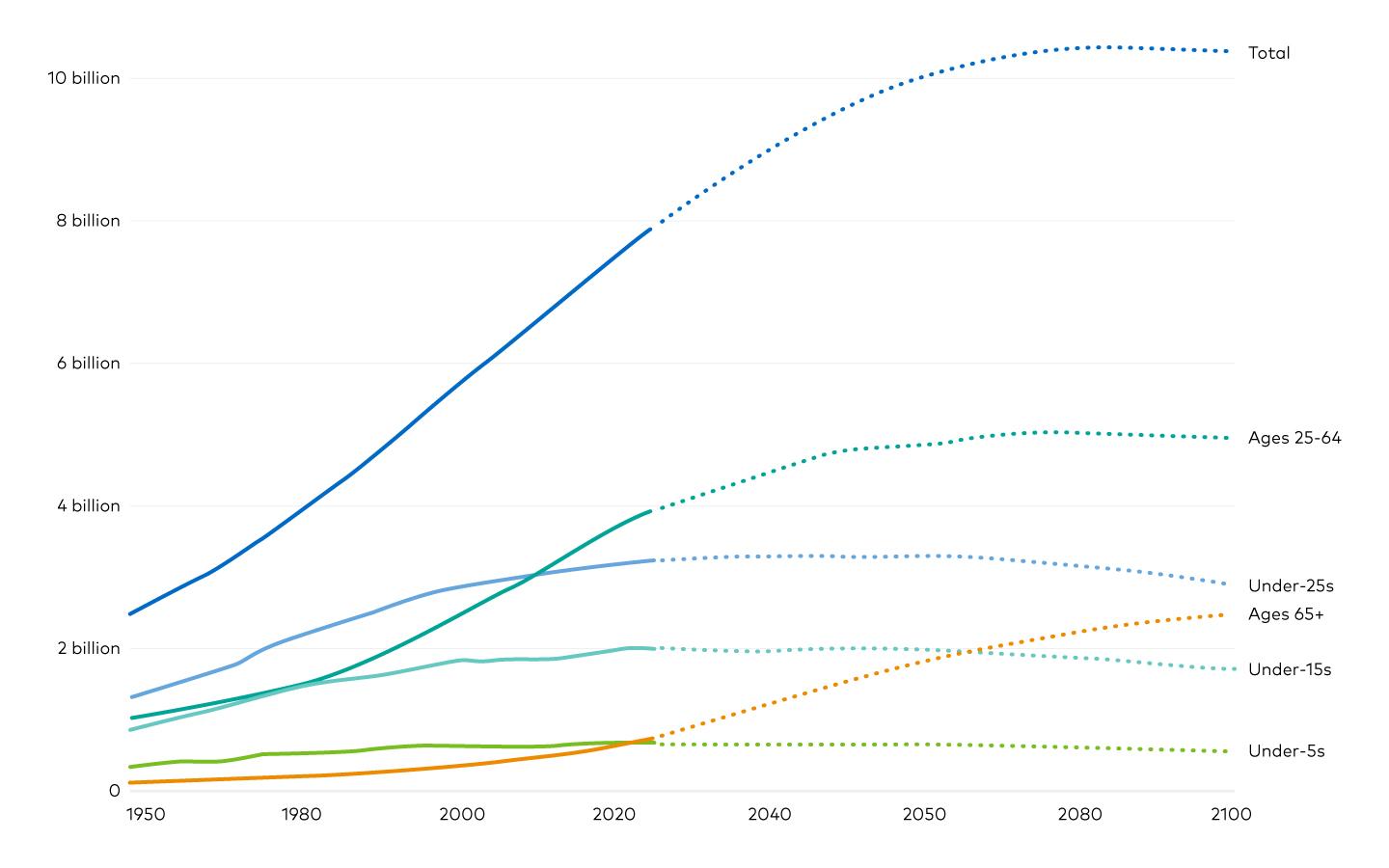

The world is getting older. According to the World Health Organization, by 2030, people over the age of 60 will comprise nearly 20% of the global population; by 2050, that age group will double, and the over-80 age group is expected to triple by 2050.1 Figure 1 provides a more dramatic view of this shift, looking back to 1950. Importantly, we believe this trend towards longer lifespans will have powerful implications for the utilization of health care products and services as individuals seek to maintain a high quality of life into their later years.

Figure 1. United Nations Populations By Age Group, Historical, and Projected

Source: UN, World Population Prospects (2022) – processed by Our World in Data. "Total" [dataset]. UN, World Population Prospects (2022) [original data].

These added years allow individuals to pursue postponed passions and potential contributions to their communities and society. Such later-life pursuits require prolonged good health, and with medical and technological advancements, aging populations will enjoy longer, more productive, and fulfilling golden years.

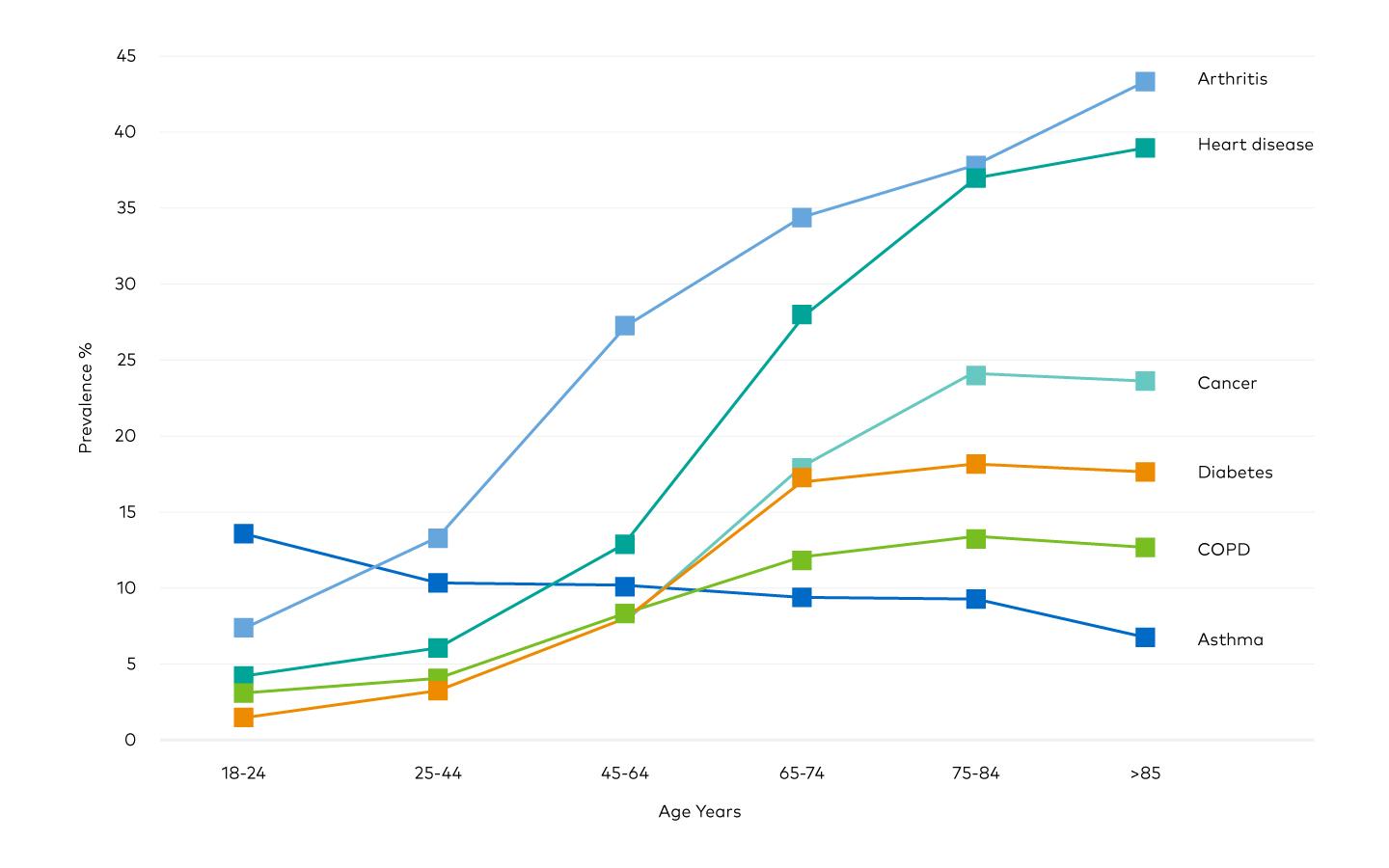

However, extended life spans come with an increased incidence of certain medical conditions–typically chronic in nature—such as heart disease, cancer, diabetes, and respiratory conditions (Figure 2). Such situations typically require continuous monitoring and management. This demographic shift towards older populations across the globe has increased awareness of the importance of preventative care and health in general, driving greater penetration of health care and medical devices in younger age cohorts.

Figure 2. Prevalence of Selected Chronic Conditions as a Function of Age

Source: Harris, Randall E., Epidemiology of chronic disease; global perspectives. Jones & Bartlett Learning, 2019.

Medtech Explained

As the name suggests, medical technology (medtech) combines the medical and technology fields. This broad discipline applies organized technological knowledge to improve health care services' quality, safety, effectiveness, and sustainability. Medtech companies potentially impact individuals from prevention to diagnosis and cure. We see its presence in everyday objects like syringes, surgical masks, gloves, glasses, and wheelchairs to more complex devices, including body scanners, gene mutation tests, implantable devices including heart valves and pacemakers, and replacement joints for knees and hips.

The area encompasses broad categories of products and services. Medical devices include products, services, or solutions that prevent, diagnose, monitor, treat, and care for individuals by physical means. In vitro diagnostics are noninvasive tests used on biological samples (e.g., blood, urine, and tissue) to determine a person's health status. Digital health refers to tools and services that use information and communication technologies to improve health and lifestyle prevention, diagnosis, treatment, monitoring, and management.

The Investment Case for Medtech

Beyond escalating global demand for medtech products and services, the structure of these businesses presents unique investment challenges and opportunities. Most medtech categories are competitively stable, with two to four players controlling the bulk of the market share, given the high barriers to entry and scale. The main factors at play start with high research & development (R&D) costs, which can reach billions of dollars annually. Further, the regulatory framework is complex in ensuring the safety of medtech products and services, with inconsistent requirements across countries and regions. Medtech companies must comply with regulations governing product design, development, manufacturing, testing, and marketing. These challenges can present difficult to nearly impossible obstacles for new entrants to overcome, and even when regulatory requirements are met, effectively scaling distribution is an additional hurdle.

Societies are aging rapidly across the globe, creating robust demand for medical equipment and treatments to address the health needs of older people. The medtech industry is highly regulated and technologically complex, which helps drive consolidation and the dominance of a select group of highly profitable, scaled businesses.

Important Disclosures

1World Health Organization. Ageing and health (who.int)

This content is provided for informational purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of June 2024 and may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. This disclosure does not identify all the risks (direct or indirect) or other considerations which might be material when entering any financial transaction.

This content has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This paper is provided for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital Management.

Medtronic is a holding in Polen's International Growth portfolio as of March 31, 2024. Siemens Healthineers is a holding in Polen's International Growth and Global Growth portfolios as of March 31, 2024. Icon PLC is a holding in Polen's International Growth and Global Growth portfolios as of March 31, 2024.

Portfolio information is shown as of March 31, 2024 and should not be construed as a recommendation to purchase, hold or sell any particular security. There is no assurance that any securities discussed herein will remain in a Polen Capital portfolio or that the securities sold will not be repurchased. The securities discussed do not represent the entire portfolio holdings. Actual holdings will vary depending on the size of the account, cash flows, and restrictions. It should not be assumed that any of the securities, transactions or holdings discussed will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. A complete list of our past specific recommendations for the last year is available upon request.

Past performance does not guarantee future results and profitable results cannot be guaranteed.

20240604-3611110