Pundits, Pollsters, and Prophets

As this November's U.S. Presidential election hype gathers momentum, the resulting—and increasing—drama is contributing to accelerating market volatility and investor anxiety. Beyond prevalent issues like healthcare, rising prices, and geopolitical and social concerns, investors are particularly focused on how the election might influence their investment portfolios.

Nearly half the world's population is facing elections throughout 2024, many with significant implications. Shortly past the midpoint of 2024, Mexico has elected its first woman president, the U.K. Labour Party's victory ended the Conservatives' 14-year tenure as the country's primary governing party, and in India's parliamentary elections, Narendra Modi won a third term leading the largest population in the world. The U.S. witnessed President Biden pass his candidacy to Vice President Kamala Harris and former President Trump survive an assassination attempt.

As investors through many election cycles, we have observed that election years often coincide with increased market volatility. We may expect volatility could be exacerbated by an interminable news cycle of speculation and conjecture about how each party may benefit from their candidate's victory in November. Though well-intentioned, compelling, and creative, it's all guesstimation. None of us knows what will transpire before, during, or after November.

At Polen Capital, we remain committed to our long-term investment strategy, undeterred by the transient nature of political events.

The Long View

Over the past fifty years, the U.S. has seen four Democratic and five Republican presidents, with much see-sawing between parties. Events within any given four-year term can be influenced by myriad factors, from catastrophes, pandemics, business booms and busts, and shifts in consumer behavior to policy initiatives aimed at economic control.

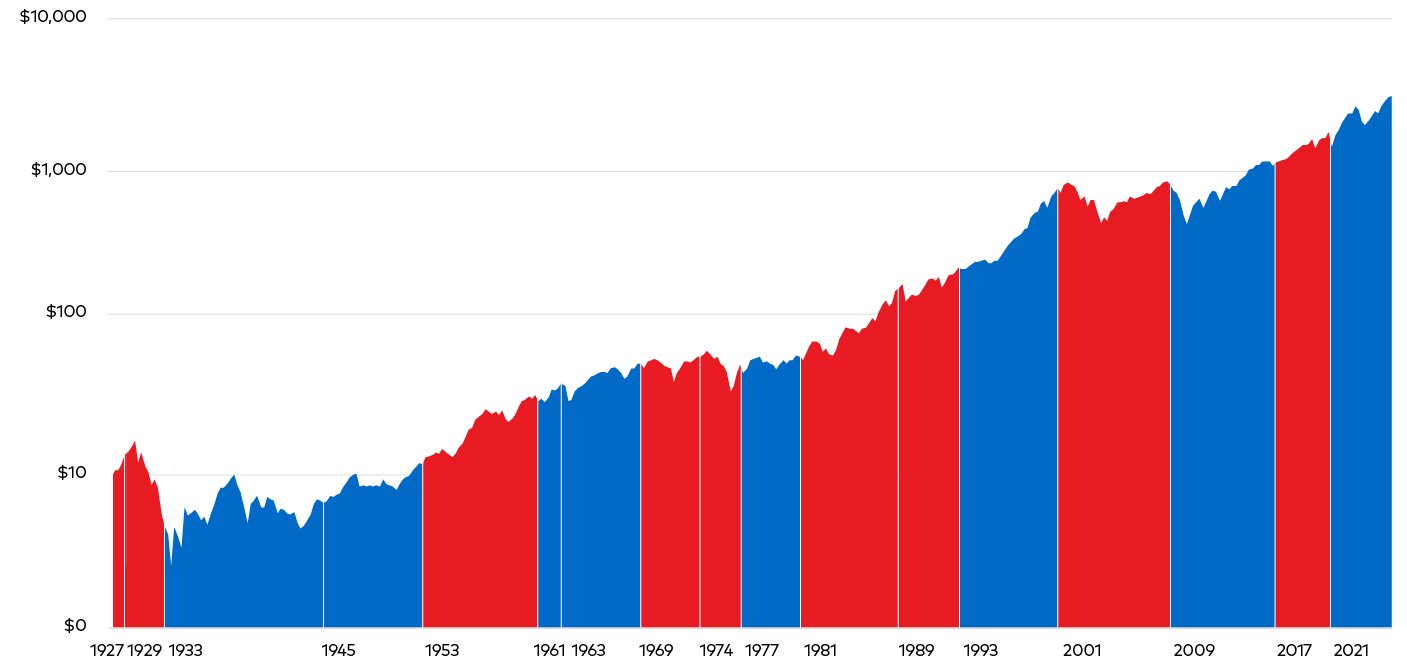

Rather than focus on any number of data points that illustrate stock market activity before, during, and after an election year, we advocate for an extended view. By examining historical data dating back to President Calvin Coolidge's term in 1926, Figure 1 observes a consistent rise in the value of an S&P 500-invested dollar. Time periods and color coding represent Presidential terms and each respective President's political party.

Figure 1. Hypothetical Growth of $1 Invested in the S&P 500 Index

Source: 1Bloomberg. The chart pictured above depicts how an investment of one dollar would have grown from 12-30-1927 through 06-28-2024, based on the actual performance of the S&P 500 Index over the same period.

This long-term perspective underscores the importance of maintaining a steady investment strategy, regardless of the political climate. We believe such an approach can yield positive returns, demonstrating the market's resilience and upward trajectory. This trajectory can be attributed to a number of factors, among them consistent economic growth, technological advancements, demographic shifts, and inflation—all of which drive corporate profits. Over the long term, the main driver of stock market gains has been earnings growth.1 We could argue that politics has more impact on the economy than the markets, which aren't the same and don't always move in tandem.

While Polen Capital's investment teams monitor short-term volatility and market movements, we take a long-term view and have done so for 30 years.

"We believe what's going to drive a solid return outcome over time is owning what we think are the right businesses through not only elections but economic environments."

Damon Ficklin, Head of Team, Portfolio Manager, Large Company Growth

Control the Controllable

We can't control macroeconomic factors, geopolitics, pre-election market anxiety, or election results. However, what we can control is the implementation of our investment philosophy.

We focus on companies with durable earnings profiles driven by sustainable advantages, financial strength, time-tested management teams, and robust products and services. Similarly, on the credit side, we strive to generate attractive risk-adjusted returns via a disciplined, bottom-up, fundamentally-oriented process strictly adhering to downside protection. With rigorous due diligence and an emphasis on margin of safety, we aim to construct concentrated portfolios capable of outperforming broad fixed income indices over a full credit cycle.

In efforts to maintain portfolios of competitively advantaged and financially robust companies, our investment teams remain informed about factors that can impact our holdings. As it relates to a Presidential administration, such factors may include policy shifts.

An Eye On Policy

Trade policy, encompassing tariffs, trade agreements, and diplomatic relations, can impact not only companies that rely on international trade but also the increasingly global nature of U.S.-based businesses. The importance of trade policy to many businesses is notable, particularly given current elevated global tensions. Corporate tax policy can have wide-ranging impacts across industries, affecting business operations, financial health, strategic decisions, and merger and acquisition activity.

Infrastructure spending could stimulate economic growth, benefiting construction, engineering, and transportation industries. Healthcare policy directly impacts the pharmaceutical and biotechnology industries, and could have extensive implications across other businesses. Policy shifts in healthcare can influence costs, compliance requirements, employee well-being, and overall competitiveness.

Beyond these examples, broader macroeconomic factors can impact our portfolio holdings. Careful consideration of such factors, which can be difficult to predict and time, is an important component of our risk management and due diligence. By monitoring policies and their potential impacts, our investment teams attempt to remain well-positioned to navigate market complexities and uncertainties while working to ensure our portfolios remain robust and resilient.

Insights & Views from Polen's Investment Teams

Investor Takeaways

- Regardless of increasing discussion and market anxiety leading up to November’s election, what will impact our portfolios is not the outcome but the performance of our portfolio companies, both now and in the future.

- We can't control macro factors, geopolitics, pre-election market anxiety, or election results. What we can control is the implementation of our investment approach.

- Through our 30-year track record, we've adhered to a consistent philosophy and process. We'll continue to face up and down markets but will stick to our beliefs and approach.

- Based on our bottom-up, high-conviction approach, we believe our equity and credit portfolios are well-positioned to generate attractive long-term returns for our clients, regardless of the specific 2024 election outcome.

Important Disclosures

2Source: MSCI. Returns stated are for the calendar year 2017. The MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. It is based on the concept of the integrated MSCI China equity universe with China A-shares included.

This information is provided for informational purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of August 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements that are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. This disclosure does not identify all the risks (direct or indirect) or other considerations which might be material when entering into any financial transaction.

Past performance does not guarantee future results and profitable results cannot be guaranteed.

The S&P 500® Index is a market capitalization weighted index that measures 500 common equities that are generally representative of the U.S. stock market. The index is maintained by S&P Dow Jones Indices.

The volatility and other material characteristics of the index referenced may be materially different from the performance achieved by an individual investor. In addition, an investor’s holdings may be materially different from those within the index. Indices are unmanaged and one cannot invest directly in an index.