Small Caps: Resilience & Agility Amid Uncertainty

The State of Small Caps

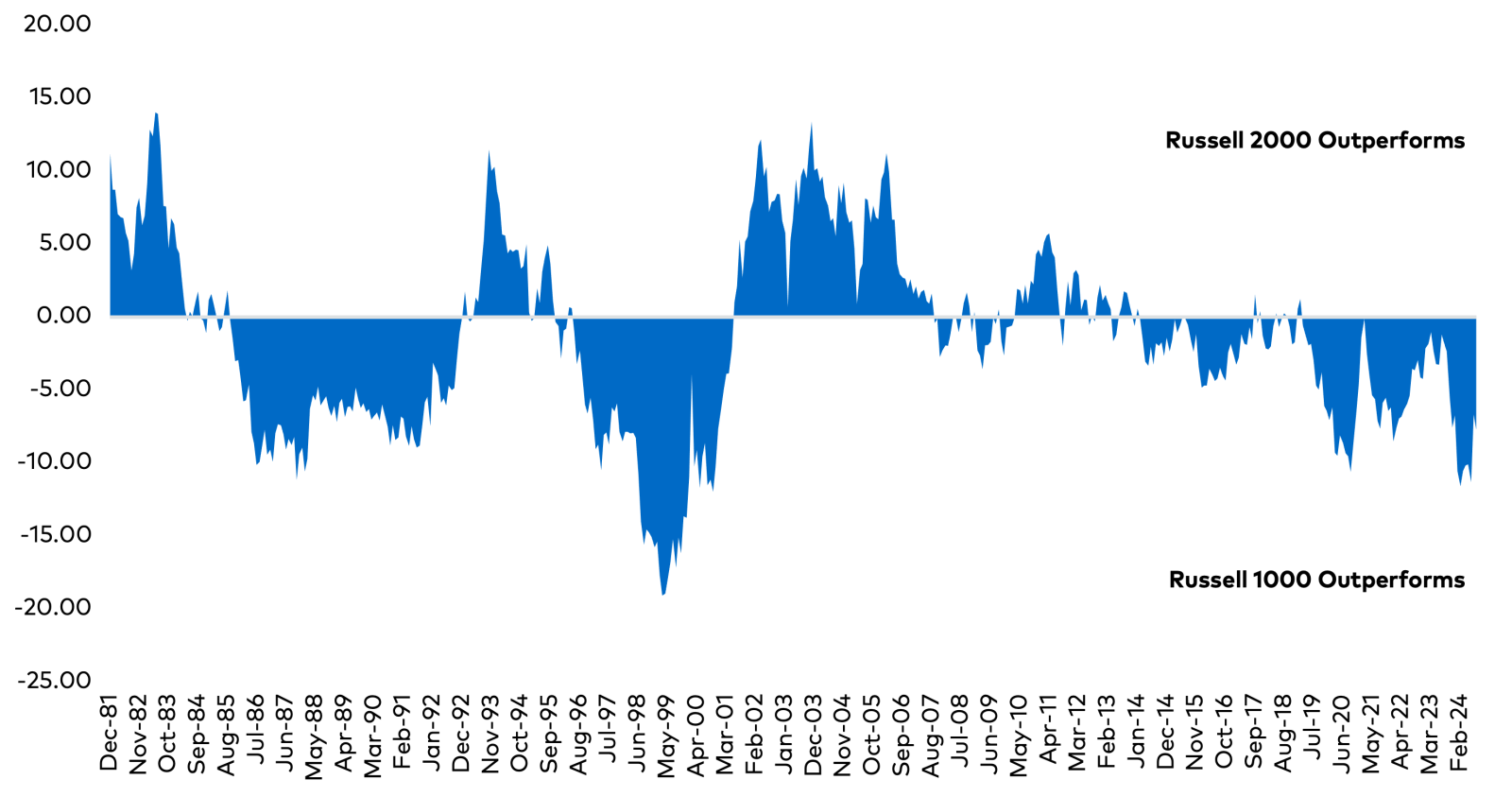

While small cap stocks have significantly lagged large caps since the Global Financial Crisis,1 over the long term it's clear small and large caps trade cycles of leadership. In fact, small caps have experienced extended periods of outperformance at various points in time, as displayed in Figure 1. While the asset class has undoubtedly faced its fair share of challenges, we continue to believe small caps with resilient business models led by agile management teams are well positioned to deliver solid performance over time.

Figure 1. Small Caps Outperform Large Caps Over Extended Periods: Rolling 3-5 Year Excess Return

Source: eVestment. Queried on 09.17.2024. It is impossible to invest directly in an index. The performance of an index does not reflect any transaction costs, management fees, or taxes.

Fast forward to 2024, and we’ve seen a mixed year for small caps partly due to the outsized impact

of two companies, SuperMicro Computer, and MicroStrategy, jointly accounting for half of the Russell 2000 Growth Index return in the first quarter. Needless to say, this was a factor in the substantial skewing of index returns and investors’ views on this segment. Later in the year, a better-than-expected July CPI report2 spurred a large rotation into small caps as investors took this as a signal that rate cuts—which tend to have an outsized positive impact on small cap companies—were on the near-term horizon. Since that mid-July announcement through the end of September, small caps outperformed large caps by +600 basis points3. The U.S. Federal Reserve did just as we expected, initiating a relatively significant half-percentage point rate cut in September.

With attractive valuations, an improving rate environment, and earnings growth that is expected to accelerate (and outpace large caps) into 2025, the conditions for sustained small cap outperformance appear to be in place. While these are certainly a reason to get incrementally positive on small caps, they should not be THE reason. As volatility increases around macro and geopolitical events, along with the lingering after-effects of the pandemic, skilled active managers are presented with an opportunity to take advantage of increasing dispersion among stocks.

High-Quality Outliers

In stark contrast to many low-quality companies characterized by unprofitable business models, high debt levels, and low returns on investment, high-quality small cap companies often display not only resilience but also adaptability in the face of uncertainty. Low-quality businesses may be compelled to make short-term decisions that could adversely impact their long-term operations. In contrast, high-quality small businesses that do not rely on external funding can play offense by leveraging their competitive advantages to gain market share during difficult periods. As such, these high-quality companies can remain “masters of their destinies.”

Small Caps: Overlooked Opportunities

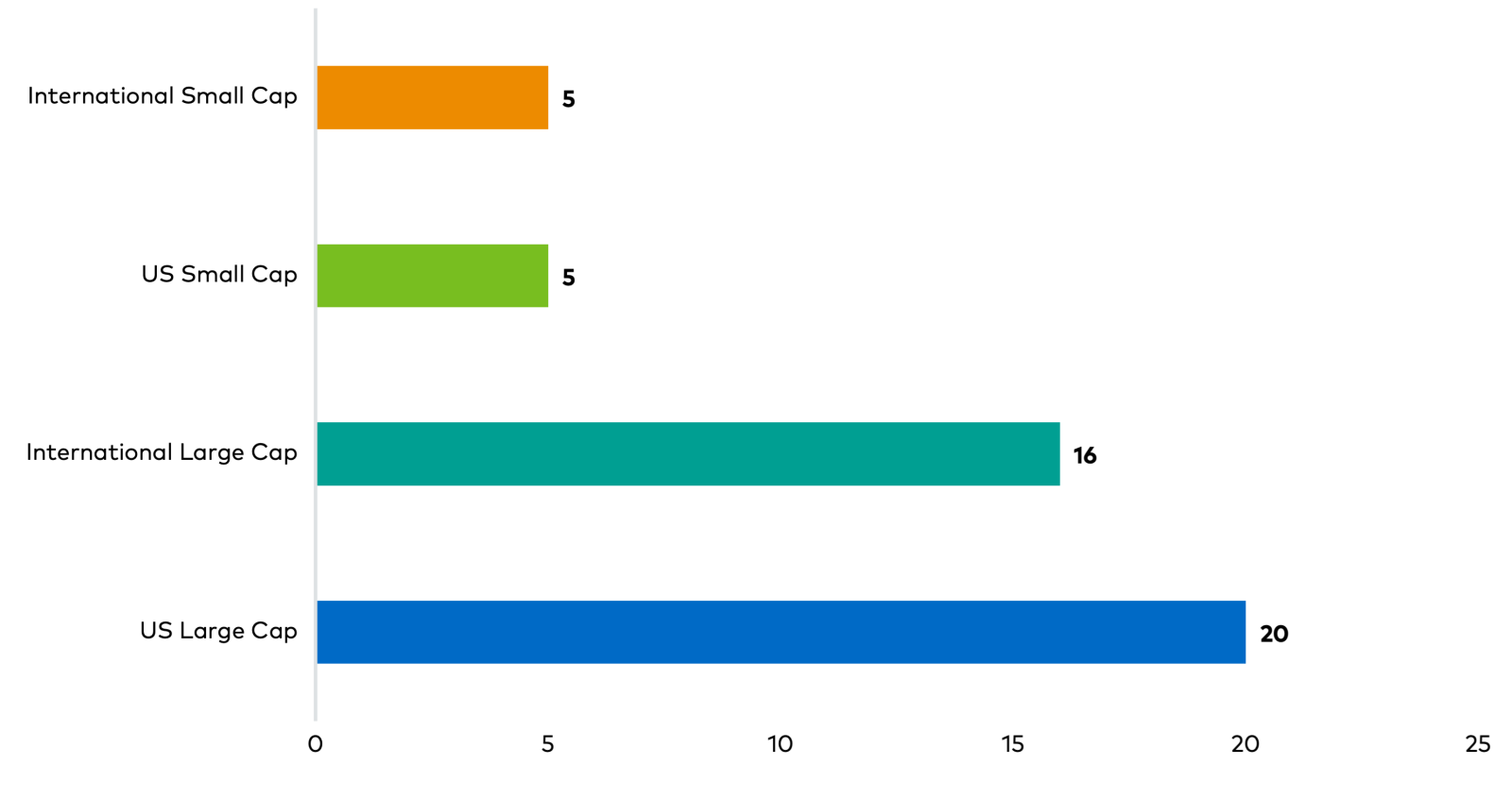

Despite the compelling opportunity set in small caps, few analysts are covering companies at this end of the market cap spectrum, as illustrated below. According to our research, small caps—inside and outside the U.S.—are among the most thinly covered asset classes, leading to inefficiencies that create opportunities for discerning managers to uncover outliers. Furthermore, we believe that the limited analyst coverage of smaller companies often results in valuations that do not reflect their intrinsic value. This creates a window of opportunity for active investors to capitalize on.

Figure 2. Small Cap Analyst Coverage

Source: Median analyst coverage by asset class. Source: Polen Capital and Bloomberg, as of 09.30.2024. Analyst estimates are from Bloomberg consensus and are subject to change over time. “International Small Cap” is represented by the MSCI AC World ex-USA Small Cap Index; “U.S. Small Cap” is represented by the Russell 2000 Index; “International Large Cap” is represented by the MSCI AC World ex-USA Large Cap Index; “U.S. Large Cap” is represented by the S&P 500 Index.

The Polen Capital Approach – Our Flywheel Framework

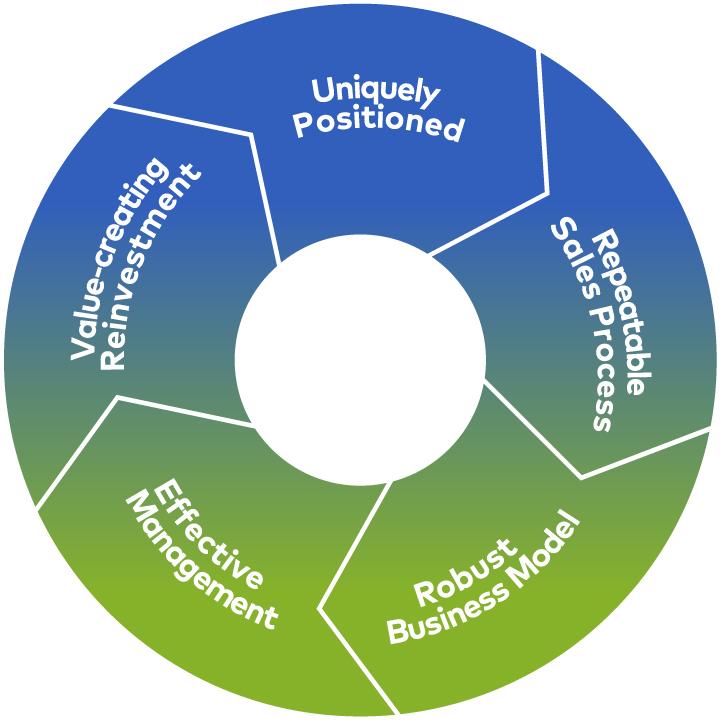

Although today’s most successful large companies began as small businesses, it is essential to highlight that not all small caps are created equal. Within the small cap universe, there is a high degree of variability in growth and quality. This is one of the reasons we analyze opportunities through our Flywheel Framework— our assessment of quality around a set of five self-reinforcing conditions that increase the odds of long-term compounding (Figure 3).

Figure 3. Our Small Cap Flywheel Framework4

While having any of these conditions creates a high bar, we demand that all five be in place to consider investing in a company. This discipline allows us to cut through the noise and confidently deploy capital for the long term. When it comes to business resilience, bigger does not always mean better. The best small cap growth companies can play defense by quickly right-sizing cost structures and becoming profitable if needed, given their high starting levels of investment. In addition, they can play offense, capitalizing on adjacent opportunities or pursuing strategic, value-added acquisitions.

Of course, many companies do not meet this high hurdle, which is why we hold a concentrated portfolio of select companies with the potential to offer growth and high returns, as well as durability, robust business models, the ability to self-fund growth, and what we believe to be superior management teams.

The Competitive Advantages of Small Businesses

A key competitive advantage, often underappreciated regardless of market conditions, is a talented, long-term-oriented management team that exercises discipline and makes swift, company-wide decisions. Founder-led companies, where the founder remains in a position of influence—such as CEO, chairperson, or board member—often showcase this essential blend of operational nimbleness and entrepreneurial culture. Since founders typically have much of their wealth invested in the business, it stands to reason that founder-led organizations prioritize long-term fiscal responsibility and strategic thinking and are aligned with the interests of minority shareholders.

Another way high-quality small companies have turned their size into an advantage is by building deep and loyal customer relationships. Though large companies often have leading market share, they typically cast a wide net and employ a “one-size-fits-all” approach to servicing their clients. Yet, many customers frequently partner with smaller companies because they seek a more customized offering and feel closer to senior management or critical decision-makers. Furthermore, being small enables organizations to target niche markets that larger companies overlook, given their focus on targeting high-volume markets.

Warby Parker: An Eye Toward Innovation

In today’s era of AI, as we embrace exciting and innovative new technologies, we also recognize the enduring value of businesses that offer traditional products and services. Small “I” innovation continues to be a vital part of our investment strategy. Guided by our Flywheel, we seek companies that deliver conventional offerings through innovative distribution methods and delivery structures or leverage technology productively, among other strategic approaches.

Warby Parker is a company that exemplifies the advantages we discuss above. It is a high-quality company that leverages its unique benefits to stand out in the market. As a retailer of prescription glasses, sunglasses, and contact lenses, the company employs an innovative business model combining direct-to-consumer sales, affordable pricing, and extensive use of technology, all while prioritizing customer experience and social responsibility. Despite facing post-COVID challenges, Warby Parker has shown promising results in 2024, demonstrating strength in its core glasses segment and optometry business, where it has made substantial investments. Having previously reduced marketing expenditures to focus on internal investments, the company is increasing its marketing efforts and experimenting with different models and channels. We look forward with a positive view towards an increasingly compelling Flywheel for Warby Parker, with improving revenue growth and profitability.

Important Disclosures

1 The Global Financial Crisis was a severe worldwide economic crisis. The National Bureau of Economic Research dates the recession around this crisis from Dec-2007 through Jun-2009.

2 Source: JP Morgan July 2024 CPI report: Inflation continues to cool, paving the way for rate cut.

3 Source: Bloomberg

4 There can be no assurance that Polen Capital will be able to implement its investment strategy or invest in companies with the characteristics mentioned. Actual characteristics may vary (in some cases materially).

This information has been prepared by Polen Capital without taking into account individual objectives, financial situations or needs. As such, it is for informational purposes only and is not to be relied on as, legal, tax, business, investment, accounting, or any other advice. Recipients should seek their own independent financial advice. Investing involves inherent risks, and any particular investment is not suitable for all investors; there is always a risk of losing part or all of your invested capital.

No statement herein should be interpreted as an offer to sell or the solicitation of an offer to buy any security (including, but not limited to, any investment vehicle or separate account managed by Polen Capital). This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Unless otherwise stated, any statements and/or information contained herein is as of the date represented above, and the receipt of this information at any time thereafter will not create any implication that the information and/or statements are made as of any subsequent date. Certain information contained herein is derived from third parties beyond Polen Capital’s control or verification and involves significant elements of subjective judgment and analysis. While efforts have been made to ensure the quality and reliability of the information herein, there may be limitations, inaccuracies, or new developments that could impact the accuracy of such information. Therefore, the information contained herein is not guaranteed to be accurate or timely and does not claim to be complete. Polen Capital reserves the right to supplement or amend this content at any time but has no obligation to provide the recipient with any supplemental, amended, replacement or additional information.

Any statements made by Polen Capital regarding future events or expectations are forward-looking statements and are based on current assumptions and expectations. Such statements involve inherent risks and uncertainties and are not a reliable indicator of future performance. Actual results may differ materially from those expressed or implied.

There is no assurance that any securities discussed herein are currently held in a Polen Capital portfolio nor that they are representative of the entire portfolio in which they are or were held. It should not be assumed that any transactions related to the securities discussed herein were (or will prove to be) profitable or that any future transactions will equal the investment performance of the securities discussed herein.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Past performance is not indicative of future results.

This information may not be redistributed and/or reproduced without the prior written permission of Polen Capital.

The MSCI ACWI ex USA Small Cap Index is a market capitalization weighted equity index that measures the performance of the small-cap segment across developed and emerging markets (excluding the U.S). The index is maintained by Morgan Stanley Capital International.

The Russell 2000® Index is a market capitalization weighted index that measures the performance of the small-cap segment of the U.S. equity universe. It is comprised of 2,000 of the smallest securities in the Russell 3000® Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The MSCI ACWI ex USA Large Cap Index is a market capitalization weighted equity index that measures the performance of the large cap segment across developed and emerging market countries (excluding the U.S). The index is maintained by Morgan Stanley Capital International.

The S&P 500® Index is a market capitalization weighted index that measures 500 common equities that are generally representative of the U.S. stock market. The index is maintained by S&P Dow Jones Indices.

It is impossible to invest directly in an index. The performance of an index does not reflect any transaction costs, management fees, or taxes.

Warby Parker is a holding in Polen’s U.S. Small Company Growth, U.S. SMID Company Growth, and Global SMID Company Growth Portfolios as of September 30, 2024.

All company-specific information has been sourced from company financials as of the relevant period discussed.